Software is not the solution

Nov 10, 2025

Your software investments are solving the wrong problem

Executive Summary

Organisations that have identified the need for richer customer insights may find themselves tempted by a software solution; data platform and technologies that provide a range of visualisations including heatmaps, funnels, session recordings and more. This is a tempting offer, decision makers know they need better insight if they want to drive impact and hope that by introducing a new software platform they will find these insights immediately available and commercial impact guaranteed.

But this is rarely the case, despite ever-increasing levels of investment in software, with the E-Commerce analytics market expected to grow to $17.2Bn by 2031 (1), organisations regularly fail to see the promised return on investment.

In this article we explore how software solutions cannot provide insight in isolation, rather these technologies provide organisations a platform for insight – the real value comes from how organisations use (or don’t use) their software to inform and prioritise activity. This is a subtle but important nuance, no matter how ‘good’ the software is, ineffective utilisation will always result in an absence of impact and poor return on investment.

Given the number of software solution available to digital teams, this article concludes that it is unlikely for an organisation to genuinely need more software, but rather an improved operating model that allows for teams to better utilise their existing software investments to deliver impact.

The Challenge

In our last article (Data is not the problem) we explored how organisations invest heavily in data but, without the right approach to insight, see little return on their investment and so enter a negative feedback loop which holds back innovation and growth in online channels.

Our recommendation is for organisations to shift their focus from ‘data’ to ‘insight’; evolving from measuring what is happening to understanding why it is happening.

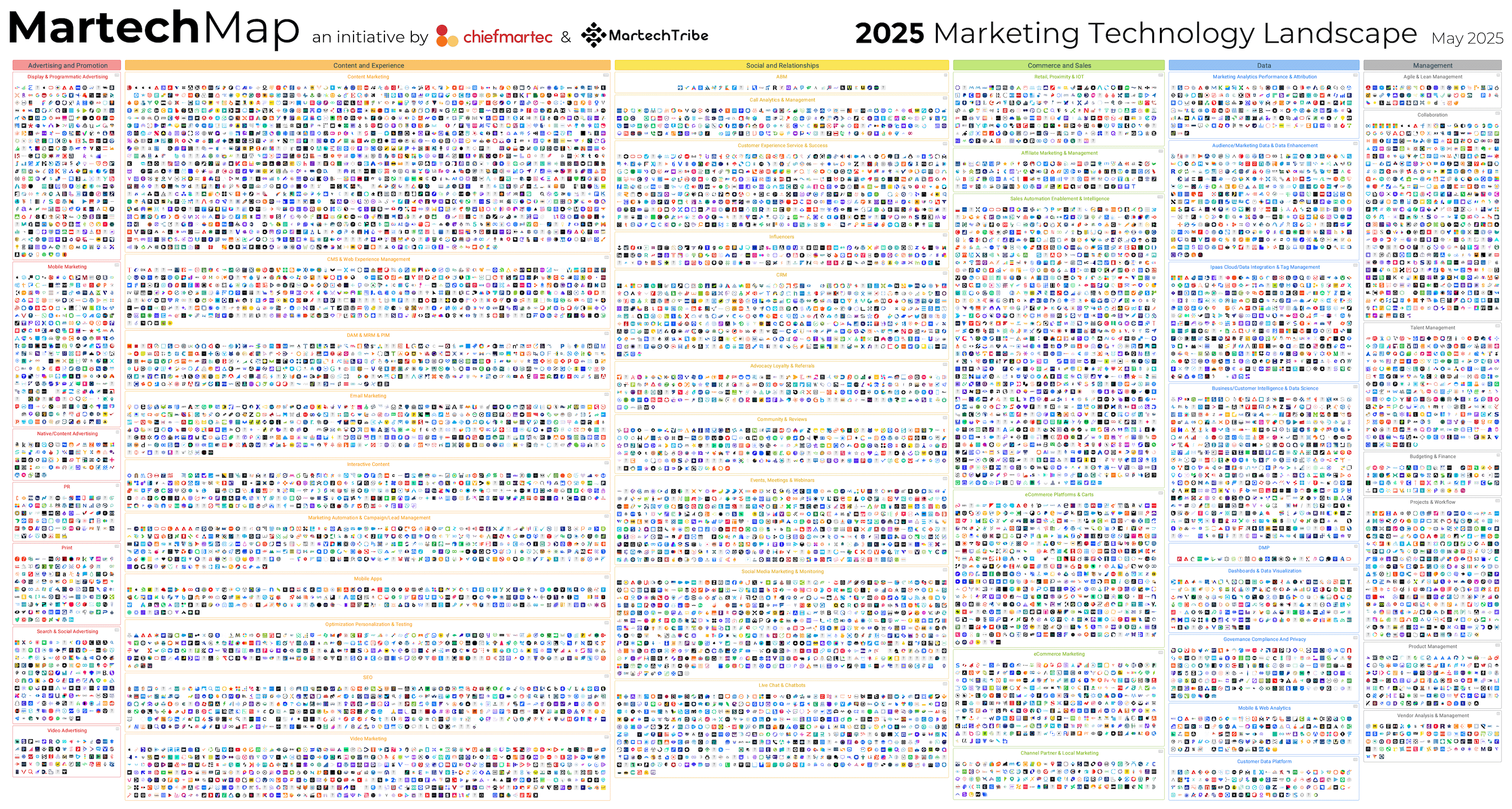

One of the approaches organisations may take in response to this need for insight is to introduce a new software solution. Evidently, many organisations having adopted this approach with the market for E-Commerce software expected to grow from $15.4Bn in 2024 to $17.24Bn in 2031 (1). The substantial growth in the size of the analytics market is mirrored by the number of software solutions available; this having grown 100x since 2011 (2).

The size of the digital technology landscape as of 2025. Sourced from chiefmartec.com

The implication of the substantial growth in the size of the software market is that software must, somehow, solve the challenge of customer insight for digital organisations and teams.

But if software were the solution, why is it that organisations continue to struggle to understand their customers and make investment decisions that deliver measurable returns on investment, despite the ever-increasing investment in software and technology?

The analysts toolbox

Before we go further, we must stress that this article is not arguing for digital teams and organisations to abandon their software - quite the opposite in fact - the right mix of software is crucial to success in online retail and journey optimisation.

It is also helpful for our purposes to organise E-Commerce software solutions by their application to digital effectiveness and innovation of online channels. (The below is by no means a full list of software suites necessary for successful e-commerce with CRM, PPC, SEO, email marketing solutions have been intentionally left out for brevity).

Broadly, we can segment software solutions (as relevant to user experience and experimentation) into several themes:

Core Data Platforms

These are the primary data analytics and visualisation platforms that e-commerce and digital teams rely on for day-to-day reporting with 99.9% of organisations using one of two software solutions for this purpose: Google Analytics (GA4) or Adobe Analytics.

For our purposes, we can also bundle data warehouses (BigQuery, Snowflake etc.) and data visualisation suites (Looker studio, PowerBI, Tableau) into core data platforms as their use is directly tied these core platforms; for example, Google BigQuery, Google Analytics and Google Looker Studio are used in concert to enable performance reporting, dashboarding and analysis by many digital teams.

Supplementary data & customer insight

These are secondary platforms that organisations use to expand upon, and contextualise, the data and reporting available within their core platforms.

This segment of software encompasses too many solutions to list here but key platforms in this space include Contentsquare, Fullstory, HotJar etc. These platforms typically provide heatmapping, surveying and simple segmentation capabilities.

Whilst these supplementary platforms are the most ‘expendable’ of the three software categories; organisations could get by without them if necessary. These platforms do provide digital teams a range of data visualisations and analyses that would be too time intensive to produce through core data platforms alone.

Outsee Analytics is a strong advocate for the effective and strategic application of these platforms, particularly as a supplementation to core platforms.

Experimentation

These platforms are focused on facilitating AB testing and most widely utilised by CRO functions. The overwhelming majority of digital teams and organisations maintain and use an experimentation platform in their data to day activity

If you have a core data platform, a supplementary insight platform and an experimentation platform you already have more than enough data to drive your insight, experimentation and innovation agenda.

The real question is why, if you already have the right software, are you struggling to drive impact?

Software solves the wrong problem

Fundamentally, these software solutions, whilst crucial for the success of digital teams, address the wrong problem with organisations simply approaching the acquisition and implementation of these platforms as being “the answer” to the challenge of “we need better insight”.

The simple purchase and installation of a new software solution, even one focused specifically on customer insight will add precisely zero value to digital teams if those digital teams do not, or cannot, use the software correctly or do not have the right process for embedding these insights within their decision making and change programmes.

The issue here lies not in the software itself, but the ability of organisations to effectively leverage these software solutions to address their commercial and strategic challenges.

The cost of failing to act

Organisations that cannot effectively leverage their software solutions fail to see any appreciable return on investment from these platforms, not only does this negatively impact growth but it also reduces the level of trust in these platforms, increases likelihood of their removal and fuels the ongoing need for 'better software' or 'more data'.

Organisations struggling to drive value from their software investments will often encounter several symptoms

Reporting the same insights in different ways

There are significant overlaps in functionality between software platforms with many platforms providing organisations very similar insights. Organisations that have ineffective operating models for the use of software frequently find themselves reporting the same data and insights, just from a variety of sources as opposed to creating new insights that provide innovative opportunities for innovation of digital customer experiences.

A lack of new insights

A common symptom of an organisation struggling to drive value through software is an absence of new data and customer insight with teams instead resorting to reporting the same insights time and again.

Limited ambition

Organisations restrict their ambition for insight and action to what is possible, rather than what would add real value.

Ineffective utilisation of software by organisations not only holds back effective decision making, but fuels a negative feedback loop that results in a lack of innovation, fading ROI and loss of ground to competitors.

What you can do about it

To reiterate, this article is not advocating for organisations to abandon their software, or that software solutions cannot contribute to significant commercial growth. Odds are, you already have the right software to deliver highly impact programmes of innovation. Rather, it is likely you need a more effective approach for leveraging the solutions you already have in place.

Organisations must lift their thinking from data analysis to answering clearly defined questions of customer engagement, behaviour and failure.

For example, it is not enough to simply “look at user engagement with the PDP” but instead to “understand how user engagement with the PDP varies by category and across visits that do and do not complete a purchase”. Answering this question requires the same data and analysis (and so the same software) but with a greater focus on understanding the drivers being user engagement, conversion and abandonment.

To support organisations lift their thinking, Outsee Analytics follows some golden rules for the effective application of software solutions to create real impact:

Ask why – simply measuring what is happening creates less value than understanding why it is happening

Focus on failure – you can’t improve by focusing on what works, it already works, instead focus on what doesn’t as this will be what puts customers off from buying and therefore presents the greatest commercial opportunity

Blend data – no software solution contains all the answers, blending data from multiple solutions produces richer customer insight and greater impact

Be specific – Focus your time on the important questions and do not produce data or insight for its own sake

A practical example

Take the example of PDP engagement, organisations may want to "look at engagement with the PDP" but this is too broad a question to deliver real value. A better objective is to understand how PDP engagement varies by category and between visits that do and do not convert.

Let's take an example of an organisation with both GA4 and Contentsquare. The following would be a good place to start:

PDP conversion rate by category, device, channel and item value

Engagement comparisons between converting and non-converting visits, identifying page elements with higher engagement in converting sessions

Voice-of-customer surveys for users who viewed but did not purchase

For example, the team might find that high-value categories with low conversion see much greater scroll depth and review engagement in converting visits, a pattern not seen in lower-value categories. This could inform actions such as surfacing reviews higher on the PDP, adding anchor links, or integrating review summaries into the image carousel.

All of the above can be achieved without additional software investment, yet produces richer insight and more impactful experimentation programmes.

Conclusion

Software solutions are a tempting route for organisations who have identified the need for better insights.

But without an operating model that allows teams to effectively utilise these platforms, organisations find themselves no closer to their customer with only a substantial software invoice and no appreciable improvement in commercial performance to justify the expense.

This is not a challenge of the software itself, but rather a misrepresentation of the problem that these platforms “solve”, software solutions do not provide you with better insight, rather they provide you the tools necessary for you to produce the insight – it all comes down to how you use them.

To address this challenge and see greater returns on software investments, organisations must lift their thinking from simply having software to blending data from multiple software solutions against strategic, customer centric objectives that provide real insight.

Organisations must ensure they have the right operating model to support their teams to deliver these activities. This can be challenging but organisations that get it right will see greater and prolonged commercial growth through experimentation programmes that respond to real, quantifiable, customer objectives.

References

https://www.verifiedmarketresearch.com/product/ecommerce-analytics-software-market

https://chiefmartec.com/2025/05/2025-marketing-technology-landscape-supergraphic-100x-growth-since-2011-but-now-with-ai/