The Black Friday Benchmark 2025

Compare and contrast the customer experience of over 100 retailers during Black Friday through a fully interactive report, for free

The Black Friday Benchmark 2025

Compare and contrast the customer experience of over 100 retailers during Black Friday through a fully interactive report, for free

The Black Friday Benchmark 2025

Compare and contrast the customer experience of over 100 retailers during Black Friday through a fully interactive report, for free

What is the Black Friday Benchmark?

What is the Black Friday Benchmark?

What is the Black Friday Benchmark?

The Black Friday Benchmark is an interactive report that allows digital leads and decision makers to compare and contrast the customer experience of over 100 retailers across 12 industry segments.

The Black Friday Benchmark is an interactive report that allows digital leads and decision makers to compare and contrast the customer experience of over 100 retailers across 12 industry segments.

The Black Friday Benchmark is an interactive report that allows digital leads and decision makers to compare and contrast the customer experience of over 100 retailers across 12 industry segments.

The Black Friday Benchmark allows you to:

The Black Friday Benchmark allows you to:

The Black Friday Benchmark allows you to:

Compare your customer experience against key competitors across 12 industry segments

Compare your customer experience against key competitors across 12 industry segments

Compare your customer experience against key competitors across 12 industry segments

Identify your strengths and weaknesses, and those of your competitors

Identify your strengths and weaknesses, and those of your competitors

Identify your strengths and weaknesses, and those of your competitors

Prioritise your investments to capture the value being left on the table

Prioritise your investments to capture the value being left on the table

Prioritise your investments to capture the value being left on the table

Gain the competitive edge through dynamic commentary and recommendations

Gain the competitive edge through dynamic commentary and recommendations

Gain the competitive edge through dynamic commentary and recommendations

Who's included

The Black Friday Benchmark is an expansive analysis of over 100 brands across 12 industry segments

Fashion retail

Fashion retail

Fashion retail

DIY

DIY

DIY

Baby

Baby

Baby

Home furnishing

Home furnishing

Home furnishing

Toys & Games

Toys & Games

Toys & Games

Health & Beauty

Health & Beauty

Health & Beauty

Electronics & Tech

Electronics & Tech

Electronics & Tech

Footwear

Footwear

Footwear

Pet

Pet

Pet

What's included

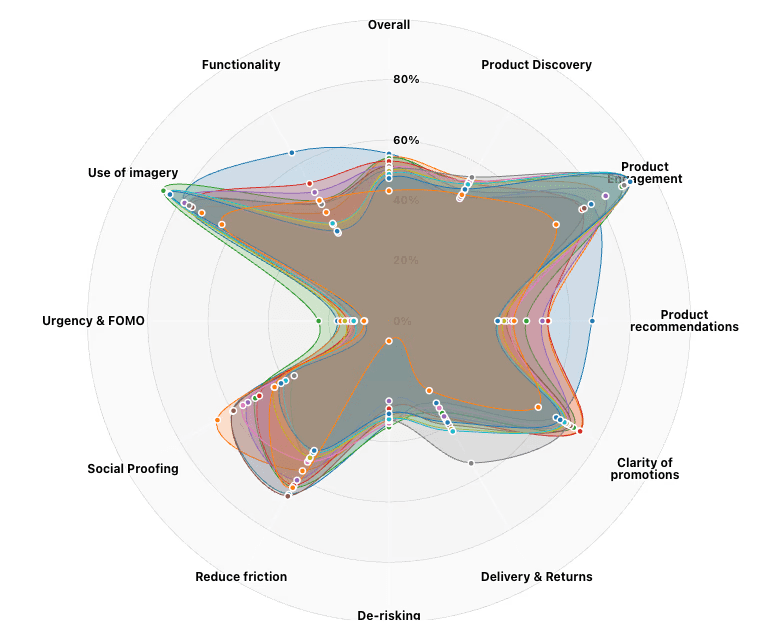

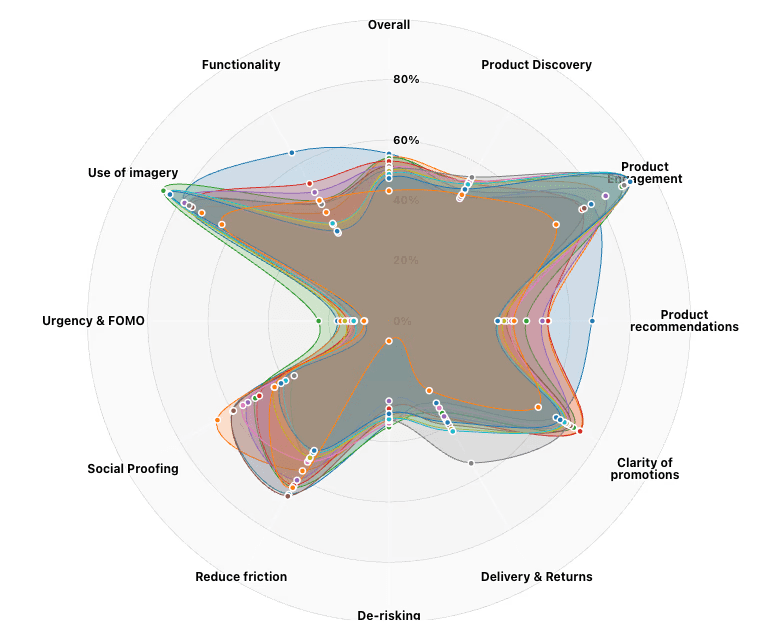

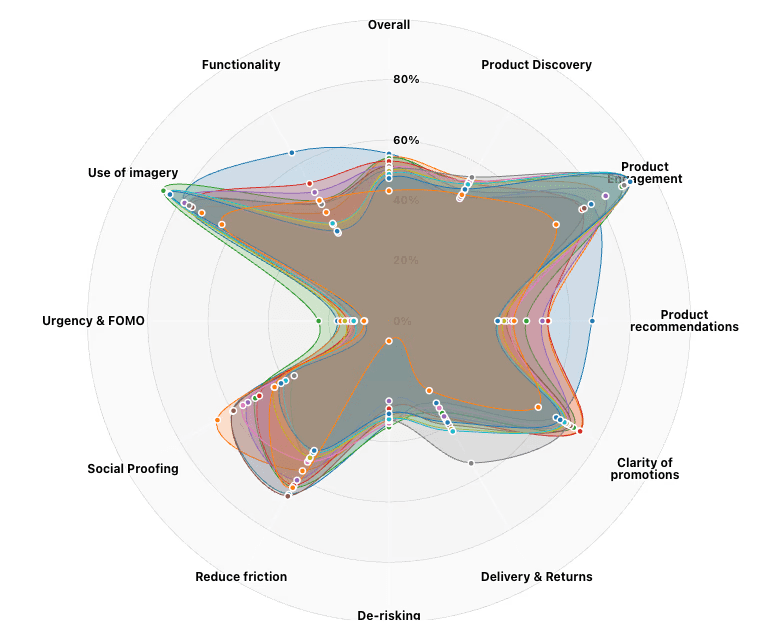

The benchmark contains an analysis of customer experience across multiple touchpoints in the customer journey; from landing page to transaction., The analysis takes 60 elements of customer experience into account, aggregated into 11 themes:

01

Product Discovery

How does the customer experience support product discovery; the ability of customers to find what they're looking for

03

Product Engagement

How does the journey engage customers with products, do PDPs present the right information in the right way

02

Product Recommendations

How effectively are product recommendations leveraged throughout the customer experience

04

Clarity of promotions

How clearly and consistently are promotions presented throughout the customer journey

05

Delivery & Returns

How clearly are delivery and returns communicated throughout the journey

06

De-risking

How effectively does the experience de-risk the purchase, mitigating likely causes of customer reluctance to buy

07

Reduce friction

How easy is it for the customer to engage and transact, are there any aspects of the experience that are likely to get in the way

08

Social proofing

To what degree is social proofing used to engage customers with products and encourage purchase

09

Urgency & Fear of missing out

How effectively does the customer experience build urgency to purchase

10

Use of imagery

How effectively and consistently is imagery used throughout the journey

11

Functionality

Does the customer experience contain the necessary functionality for customer succes

01

Product Discovery

How does the customer experience support product discovery; the ability of customers to find what they're looking for

03

Product Engagement

How does the journey engage customers with products, do PDPs present the right information in the right way

02

Product Recommendations

How effectively are product recommendations leveraged throughout the customer experience

04

Clarity of promotions

How clearly and consistently are promotions presented throughout the customer journey

05

Delivery & Returns

How clearly are delivery and returns communicated throughout the journey

06

De-risking

How effectively does the experience de-risk the purchase, mitigating likely causes of customer reluctance to buy

07

Reduce friction

How easy is it for the customer to engage and transact, are there any aspects of the experience that are likely to get in the way

08

Social proofing

To what degree is social proofing used to engage customers with products and encourage purchase

09

Urgency & Fear of missing out

How effectively does the customer experience build urgency to purchase

10

Use of imagery

How effectively and consistently is imagery used throughout the journey

11

Functionality

Does the customer experience contain the necessary functionality for customer succes

Read the report

An exploration of the results, key insights and recommendations that organisations should action now to gain the advantage in 2026

Read the report

An exploration of the results, key insights and recommendations that organisations should action now to gain the advantage in 2026

Read the report

An exploration of the results, key insights and recommendations that organisations should action now to gain the advantage in 2026

Results overview

Across industry segments the benchmark reveals clear consistencies in customer experience with many retailers showing significant attention being paid to product engagement, imagery, social proofing and visibility of promotions. These are consistent with e-commerce best practices and indicate a high level of investment in optimisation.

On the other hand we see consistent under-utilisation of urgency messaging and de-risking across retailers and segments alongside inconsistent use of product recommendations and persistent shortcomings in customer experiences that facilitate product discovery, browsing and consideration.

The data suggests that retailers are heavily optimisation for conversion, focusing their activity on the small proportion of users who are in a buying mindset, but in doing so failing to account for the intent of the majority of users who are not yet ready to convert.

There is a significant opportunity to expand experimentation programmes beyond simple conversion rate optimisation

Womens fashion

Baby

Home Furnishing

Toys & Games

Health & Beauty

Electronics & Tech

Kids fashion

Footwear

Mens Fashion

All fashion

Pet

Key insights

The benchmarking data points to five key themes

01

Urgency messaging

There is low use of urgency messaging throughout the customer experience across retailers and segments. Whilst some retailers utilised countdowns and other urgency messaging at the top of the funnel, most typically countdown timers or communication of the end date of the promotional period, these messages were utilised sporadically throughout the customer journey, primarily on the homepage and within global banners. There are almost no examples of retailers that reinforce urgency within the cart and checkout.

02

De-risking

There is little consistent use of de-risking messaging throughout customer experiences and where it is present the user’s attention is not called to it. This is even in the case where there are strong de-risking signals e.g. free returns (by post or in store), good retailer reviews and fit guidance and assurance. Returns information is rarely available within the product experience (PLP and PDP) and only reinforced within the purchase stage of the journey (cart, checkout) in a few instances.

03

Product discovery

Few retailers optimise for product discovery, whilst most users are likely to land on the PDP, those users who engage with the product discovery experience (PLP) are rarely supported. Key components for easy and effective product discovery are missing across many retailers and segments. For example, use of quick filters, easy visibility of applied filters or filtering for discounts/depth of promotions.

04

Product recommendations

Product recommendations and recommendations rails are utilised by almost all retailers included in the benchmark but with significant variation in effectiveness. Some retailers include sparse recommendations with no call to action, no promotional badging, no reviews etc. whilst some approach recommendations rails as a micro-PLP; including reviews, social proofing, options, size information, promotional badging etc.

05

Functionality

In many cases there is a lack of helpful functionality for the customer, with many retailers not offering shoppable PLPs or recommendations rail and poor presentation of applied filters within the PLP. These shortfalls in customer experience contribute to confusion, frustration and abandonment.

01

Urgency messaging

There is low use of urgency messaging throughout the customer experience across retailers and segments. Whilst some retailers utilised countdowns and other urgency messaging at the top of the funnel, most typically countdown timers or communication of the end date of the promotional period, these messages were utilised sporadically throughout the customer journey, primarily on the homepage and within global banners. There are almost no examples of retailers that reinforce urgency within the cart and checkout.

02

De-risking

There is little consistent use of de-risking messaging throughout customer experiences and where it is present the user’s attention is not called to it. This is even in the case where there are strong de-risking signals e.g. free returns (by post or in store), good retailer reviews and fit guidance and assurance. Returns information is rarely available within the product experience (PLP and PDP) and only reinforced within the purchase stage of the journey (cart, checkout) in a few instances.

03

Product discovery

Few retailers optimise for product discovery, whilst most users are likely to land on the PDP, those users who engage with the product discovery experience (PLP) are rarely supported. Key components for easy and effective product discovery are missing across many retailers and segments. For example, use of quick filters, easy visibility of applied filters or filtering for discounts/depth of promotions.

04

Product recommendations

Product recommendations and recommendations rails are utilised by almost all retailers included in the benchmark but with significant variation in effectiveness. Some retailers include sparse recommendations with no call to action, no promotional badging, no reviews etc. whilst some approach recommendations rails as a micro-PLP; including reviews, social proofing, options, size information, promotional badging etc.

05

Functionality

In many cases there is a lack of helpful functionality for the customer, with many retailers not offering shoppable PLPs or recommendations rail and poor presentation of applied filters within the PLP. These shortfalls in customer experience contribute to confusion, frustration and abandonment.

01

Urgency messaging

There is low use of urgency messaging throughout the customer experience across retailers and segments. Whilst some retailers utilised countdowns and other urgency messaging at the top of the funnel, most typically countdown timers or communication of the end date of the promotional period, these messages were utilised sporadically throughout the customer journey, primarily on the homepage and within global banners. There are almost no examples of retailers that reinforce urgency within the cart and checkout.

01

Urgency messaging

There is low use of urgency messaging throughout the customer experience across retailers and segments. Whilst some retailers utilised countdowns and other urgency messaging at the top of the funnel, most typically countdown timers or communication of the end date of the promotional period, these messages were utilised sporadically throughout the customer journey, primarily on the homepage and within global banners. There are almost no examples of retailers that reinforce urgency within the cart and checkout.

02

De-risking

There is little consistent use of de-risking messaging throughout customer experiences and where it is present the user’s attention is not called to it. This is even in the case where there are strong de-risking signals e.g. free returns (by post or in store), good retailer reviews and fit guidance and assurance. Returns information is rarely available within the product experience (PLP and PDP) and only reinforced within the purchase stage of the journey (cart, checkout) in a few instances.

02

De-risking

There is little consistent use of de-risking messaging throughout customer experiences and where it is present the user’s attention is not called to it. This is even in the case where there are strong de-risking signals e.g. free returns (by post or in store), good retailer reviews and fit guidance and assurance. Returns information is rarely available within the product experience (PLP and PDP) and only reinforced within the purchase stage of the journey (cart, checkout) in a few instances.

03

Product discovery

Few retailers optimise for product discovery, whilst most users are likely to land on the PDP, those users who engage with the product discovery experience (PLP) are rarely supported. Key components for easy and effective product discovery are missing across many retailers and segments. For example, use of quick filters, easy visibility of applied filters or filtering for discounts/depth of promotions.

03

Product discovery

Few retailers optimise for product discovery, whilst most users are likely to land on the PDP, those users who engage with the product discovery experience (PLP) are rarely supported. Key components for easy and effective product discovery are missing across many retailers and segments. For example, use of quick filters, easy visibility of applied filters or filtering for discounts/depth of promotions.

02

Product recommendations

Product recommendations and recommendations rails are utilised by almost all retailers included in the benchmark but with significant variation in effectiveness. Some retailers include sparse recommendations with no call to action, no promotional badging, no reviews etc. whilst some approach recommendations rails as a micro-PLP; including reviews, social proofing, options, size information, promotional badging etc.

02

Product recommendations

Product recommendations and recommendations rails are utilised by almost all retailers included in the benchmark but with significant variation in effectiveness. Some retailers include sparse recommendations with no call to action, no promotional badging, no reviews etc. whilst some approach recommendations rails as a micro-PLP; including reviews, social proofing, options, size information, promotional badging etc.

05

Functionality

In many cases there is a lack of helpful functionality for the customer, with many retailers not offering shoppable PLPs or recommendations rail and poor presentation of applied filters within the PLP. These shortfalls in customer experience contribute to confusion, frustration and abandonment.

05

Functionality

In many cases there is a lack of helpful functionality for the customer, with many retailers not offering shoppable PLPs or recommendations rail and poor presentation of applied filters within the PLP. These shortfalls in customer experience contribute to confusion, frustration and abandonment.

Recommendations

Recommendations

Recommendations

Across retailers and industry segments, the Black Friday Benchmark points to several key insights and actions that decision makers should consider for further investigation and experimentation in 2026:

Across retailers and industry segments, the Black Friday Benchmark points to several key insights and actions that decision makers should consider for further investigation and experimentation in 2026:

Across retailers and industry segments, the Black Friday Benchmark points to several key insights and actions that decision makers should consider for further investigation and experimentation in 2026:

Focus on building urgency

There is consistent under-utilisation of urgency timers, countdowns, low stock messaging etc. and de-risking information, for example returns. Organisations that focus on testing the introduction of these messages will establish a competitive advantage in 2026

Product recommendations

Evolve the utilisation of product recommendations, whilst these are a ubiquitous component of e-commerce customer experiences, they remain poorly utilised in many cases – often being little more than product images and prices, organisations that focus on testing the impact of social proofing, review scores, discount/promotion badging etc. within recommendation rails will be capturing an opportunity to drive average basket sizes rarely used by the competition

Quality of life & functionality

Prioritise testing of new functionality and quality of life features that make customer engagement and conversion as easy and seamless as possible, many retailers employ best practice features (e.g. filtering within the PLP) but without the supporting functionality to make the customers life easier e.g. easy visibility of applied filters

Conclusion

The Black Friday Benchmark highlights how the level of standardisation in e-commerce experiences both benefits and holds back retailers, consistency in experience allows customers to engage and convert with new brands more easily but at the same time makes it harder for brands to stand out.

In focusing on keeping pace with best-practices, retailers have overlooked the role of urgency messaging, transaction de-risking and ensuring effective product recommendations.

Retailers are, likely, so focused on keeping pace with their competitors that they forget to enhance these fundamental customer experiences with content and experience that encourage customers to buy, rather than just giving them the option to.

The challenge going into 2026 will not be enabling the customer to buy, it will be giving them a reason to.

Conclusion

The Black Friday Benchmark highlights how the level of standardisation in e-commerce experiences both benefits and holds back retailers, consistency in experience allows customers to engage and convert with new brands more easily but at the same time makes it harder for brands to stand out.

In focusing on keeping pace with best-practices, retailers have overlooked the role of urgency messaging, transaction de-risking and ensuring effective product recommendations.

Retailers are, likely, so focused on keeping pace with their competitors that they forget to enhance these fundamental customer experiences with content and experience that encourage customers to buy, rather than just giving them the option to.

The challenge going into 2026 will not be enabling the customer to buy, it will be giving them a reason to.

Conclusion

The Black Friday Benchmark highlights how the level of standardisation in e-commerce experiences both benefits and holds back retailers, consistency in experience allows customers to engage and convert with new brands more easily but at the same time makes it harder for brands to stand out.

In focusing on keeping pace with best-practices, retailers have overlooked the role of urgency messaging, transaction de-risking and ensuring effective product recommendations.

Retailers are, likely, so focused on keeping pace with their competitors that they forget to enhance these fundamental customer experiences with content and experience that encourage customers to buy, rather than just giving them the option to.

The challenge going into 2026 will not be enabling the customer to buy, it will be giving them a reason to.

Access The Black Friday Benchmark

Access The Black Friday Benchmark

The fully functional, interactive Black Friday Benchmark is available below. No need to register, no email requirements - just free, high quality industry insights.

Simply select your target organisation and work through each page in turn for competitor comparisons, commentary and automated recommendations.

The benchmark is intended for use on desktop only. You can use the link below to email yourself a link to the benchmark. If you are on a desktop device but the benchmark is not visible you need to make your browser window wider.