Data is not the problem

Nov 5, 2025

Commercial impact is not held back by the lack of data, but by the lack of insight

Executive summary

A common challenge to effective decision making in digital organisations is the misconception that teams need more data, or that having access to more data will solve the strategic and organisational challenges that limit decision making and hold back commercial impact.

In truth, a lack of data is rarely, if ever, the real challenge holding back decision making and commercial growth.

In 2025, the E-Commerce data industry was estimated to be worth $25 Billion and expected to grow to $97 Billion by 2035 (1) with hundreds of software solutions available to organisations across data warehouses, BI suites and customer insight platforms (to name a few). Given the sheer size of the data landscape, it is extremely unlikely that a lack of available data is a genuine challenge facing organisations.

This begs the question; why do organisations believe they need more data and what are the real challenges they are struggling with?

The real challenge is not a lack of data – the understanding of what is happening, but the lack of understanding as to why it is happening – a lack of insight.

In this article, we examine how organisations conflate data with insight, and how a lack of insight is the real barrier to effective decision making in digital organisations.

This article concludes by recommending that organisations stop focusing on the 'data' and rather focus on better defining the, customer-centric, questions that will allow for more effective decision making. This necessitates a shift in mindset from “organisation-first” to “customer-first”, but one that, if adopted, will lead to better decision making and greater commercial impact of digital investments.

The challenge

Organisations invest vast amounts of time, money and resources in data warehouses, visualisation and BI suites, marketing analytics, customer insight and experimentation platforms to name a few.

This is driving substantial growth in the E-Commerce analytics market with the value of the market estimated to grow from $25Bn in 2025 to £83Bn by 2023 (1).

But when we compare the expected rate of growth of E-Commerce data to the rate of growth in E-Commerce customer spending, we find that whilst the analytics market is expected to growth 200% to 2033 the E-Commerce market (i.e. customer spending) is only expected to growth by 75% in the same period (2, 3).

The rate of growth in the cost of data outstrips the rate of growth of the market it supports.

This highlights the challenge facing digital organisations; that the ever-increasing level of investment required for “data” is not delivering the promised commercial impact and is, paradoxically, limiting decision making with organisations investing in 'more data' simply for the sake of having 'more data'

In reality, the challenge is not that organisations are unable to measure what is happening (the data) but struggle to understand why it is happening (the insight).

Data vs Insight

Already we are encountering an important nuance in e-commerce analytics; that of the difference between data and insight.

These terms are often used interchangeably but they have different meanings, and it is essential for organisations and teams remain aware of the difference.

Data - The understanding of what is happening

The following are examples of data:

The website receives 100K visits per month

The website makes £250K per month in online sales

We spend £25K per month in pay-per-click advertising

Insight - The understanding of why it is happening

The following are examples of insight:

Website traffic has decreased 5% compared to last year due to an increase in cost per click for paid marketing on desktop devices that is reducing click volumes despite a consistent level of investment and click through rate.

Online revenue has increased 3% compared to last year despite a consistent conversion rate, rather we have seen a 3% uplift in average order value driven through a 5% uplift in average item value but a 2% decline in average basket size; the increase in price due to cost pressures has increased revenue but at the cost of a reduction in basket size

Our paid marketing spend is unchanged year on year but due to an increase in cost per click as a result of competitor activity we are seeing lower levels of traffic through paid channels

In each of the above examples, whilst data is a necessary description of what is happening, it is the insight that contextualises this data and informs subsequent decision making.

It is through the combination of both what (data) and why (insight) that commercially impactful decisions are made.

The cost of failing to act

A perceived lack of data causes organisations to invest more time and money in closing the “gaps” in data, often through the acquisition and implementation of additional software solutions or substantial increases to investment in existing data architecture.

But the implementation of new software in and of itself does not create insight (as we will explore in our next article) and so the additional time and financial investments fail to deliver the expected commercial impact. This in turns results in the organisation losing faith in their data and degrades the value placed on data, this pressures causes decision makers to identify a need for “more, better data” and the cycle repeats again.

By failing to address this challenge, organisations enter a negative feedback loop that limits effective decision making, reduces impact and degrades the perceived value, and utilisation, of data within the organisation. Whilst placing ever growing commercial pressure on digital teams to deliver growth.

Organisations find themselves having to make ever-increasing investments in their data but never see the promised return on investment.

What you can do about it

To solve the challenge of 'data', organisations must evolve their thinking from short-term responses to challenges or commercial pressures and towards a more considered, strategic approach informed by real customer insights. It is worth noting here that strategic does not mean slow - effective organisations can create and action nuanced customer insights at speed if they have the correct operating model (as we will explore in a later article)

A good framework for producing such insights is to focus on answering specific questions, for example “why do 50% of users on the PDP not engage with product images?" (see ’a practical example’ for more detail)

This will feel counterproductive as it is a more considered process than simply changing elements of the customer experience or marketing strategy and hoping these changes drive value, but over time this approach – of building and responding to measurable customer insights – generates greater impacts in revenue and delivers a higher return on investment than any short term activity.

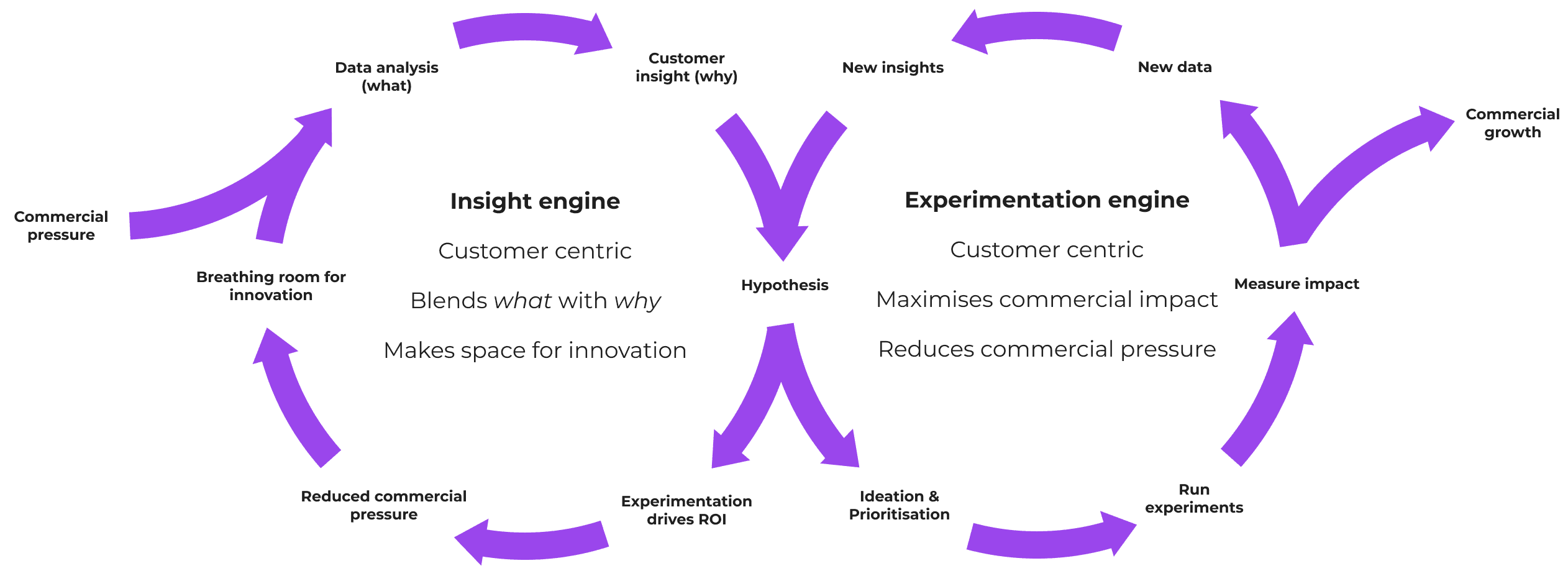

Outsee Analytics works with organisations to support the change from measuring what to understanding why and through the migration to this approach, organisations can move progress towards an always on, scientific, programme of commercial impactful experimentation; that we call the Growth Engine.

A practical example

Imagine a team tasked with increasing PDP conversion by 1%, perhaps due to rising PPC costs or increased competitor activity. The team recognises the need for both data (what is happening) and insight (why it is happening). But without clear, customer-centric questions, they risk defaulting to “we need more data” and failing to generate impact

What are the question that, when answered, will provide the team a depth of insight to inform experimentation:

How does PDP abandonment vary by channel, device and customer segment?

How much abandonment is driven by factors outside our control (price, delivery cost, stock availability)?

What are the main sources of customer frustration on the PDP?

To what extent do product characteristics (price, category, attributes) influence abandonment?

How do competitors execute their PDPs, and where do they outperform us?

If, for example, the insight suggests that a lack of stock availability due to size drives c. 15% of PDP abandonment and that PDP exit rate increases significantly for products with less than 75% of variants being available in key sizes, the team might conclude that for products with less than 75% availability there is a need to test an experience that encourages users to engage with similar products that are available in the correct size and colour/style, this may be delivered as a pop-up on abandonment behaviour or within the image carousel itself.

If this barrier to conversion contributes to 15% of total PDP abandonment and that this response addresses 1% of the issue, we would see a 0.15% uplift in overall PDP conversion (proportion of failures * scale of impact; 15% * 1%). This may not seem like much, but it would capture c. 15% of the target 1% uplift in PDP conversion – not a bad start for a blend of insight that could be produced within a few days.

Conclusion

To conclude, organisations often lament a perceived lack of data as being the barrier to effective decision making and commercial growth, but rarely is this the case. In reality, organisations are limited by a lack of insight - an understanding not of what is happening, but of why.

Organisations struggling with this challenge find themselves in a negative feedback loop whereby no level of investment in data is ever enough. This drives frustration which over time degrades trust and the of value of data within the organisation which results in loss of ground to competitors who always seem to be one step ahead.

To combat this challenge, organisations must shift from asking “what is happening” to asking “why it is happening”, making time for the necessary interrogation of customer behaviour, engagement and abandonment to produce detailed, and actionable, insights that deliver real commercial impacts.

This is where Outsee Analytics specialises, bringing the scientific method to digital analytics to empower organisations with a deeper understanding of the customer that delivers real, verifiable, commercial impact.

References

www.businessresearchinsights.com/market-reports/e-commerce-analytics-market-102447

www.businesswire.com/news/home/20250528045768/en/E-Commerce-Market-Growth-Trends-and-Forecast-Report-2025-2033-AI-Enhancements-and-Virtual-Fitting-Rooms-Revolutionize-Online-Shopping-Experience---ResearchAndMarkets.com

www.researchandmarkets.com/report/e-commerce