The Digital Treadmill

Nov 19, 2025

You're running as fast as you can, so why are you going backwards?

Executive Summary

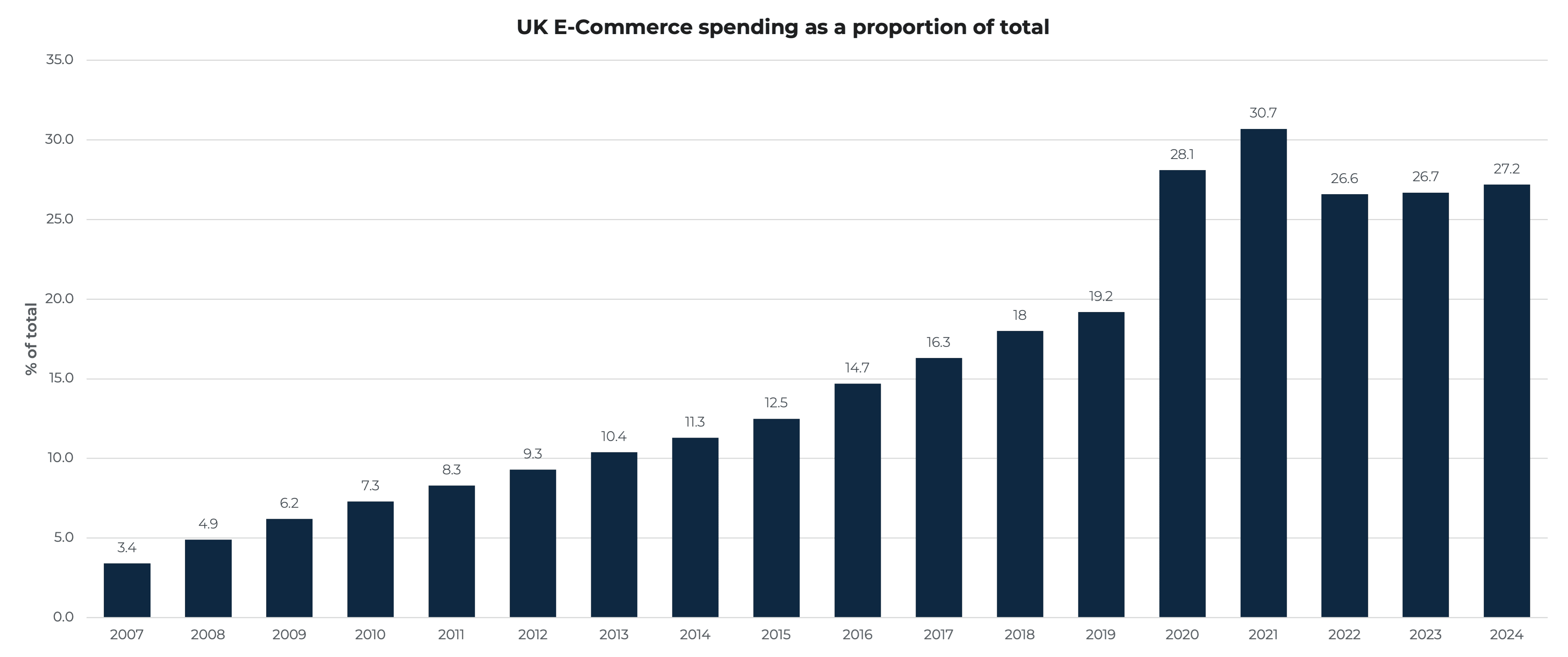

Since 2010 E-Commerce spending as a percentage of total retail has increased from 7% to 27% with there being 166,000 E-Commerce retailers registered in the UK as of last count (2024). This rate of growth in E-Commerce is expected to continue to £115Bn by 2023 (1, 2).

Customers are spending more than even in digital channels and have a wider choice of retailers than at any point in the last 15 years.

At the same time, the technology landscape has expanded significantly with the advancement of AI fuelling the fastest rate of innovation in digital commerce than at any point since 2010, even during the pandemic.

So why, despite the level of growth in both the market and technology, do organisations find themselves struggling to innovate, rarely seeing the promised return of their investments and always feeling like they’re staying still or, worse, moving backwards?

In this article we examine how the gap between the pace of technological change and the ability of organisations to keep up is widening and how the historical strategy to bridge the gap (more spending), is no longer practical – there is always a new technology, a new trend or a new AI solution that requires your attention, money and time.

Organisations are stuck on a treadmill that is moving faster than they can hope to keep up.

The result? Organisations are working as hard and a fast as possible, spending increasing amounts of time and money but feel like they’re falling behind, chasing a return on investment that never seems to materialise.

This need to ‘innovate’ further increases pressure of teams and decision makers, which only results in the need for more; more investment, more technology, more ‘innovation’… as organisations work harder to move forward, more often than not, they only fall further behind.

The truth is that organisations cannot ‘run faster’ to keep up with the pace of technological change, and they cannot simply spend more – budgets are tightening and technology becoming more expensive.

Rather, organisations must be more focused in their activity, prioritising their investments in technology through data, guided by insight and validated through experimentation.

This applies throughout the digital customer experience, not only in the optimisation of digital channels themselves but also in email and digital marketing, social media, creative, product roadmaps and more.

Organisations that successfully embed this process - the scientific method - into their operating models will find themselves able to make smarter investments in technology, respond to real customer insights and address the root causes of abandonment in online channels that represent the real commercial opportunity.

Running forwards, moving backwards

E-Commerce has grown significantly over the last fifteen years with online spending increasing from c. 19% of total retail spending in 2019 to c. 27% in 2024 (1). Whilst this has dropped off slightly since the pandemic, in the three years prior to 2025 e-commerce consistently accounts for over 25% of total retail spending in the UK (see below).

Customer spending in E-Commerce as a percentage of total retail (2)

At the same time, since the pandemic, there has been a substantial increase in the number of online retailers customers can choose from with 56K new e-commerce companies being founded in 2024 alone – this being 75% higher than the number of new e-commerce companies founded in 2021 (the peak of the pandemic). The total estimated number of e-commerce companies in 2024 being 166,000 (2).

Evidently, not only has customer spending in online channels increased but so has the range of retailers available for customers to choose from. This is expected to drive a c. 21% uplift in total e-commerce spending from c. £95Bn in 2024 to c. £115Bn in 2030 (3).

This would all seem like good news for online retailers and digital organisations, and in many ways it is. Organisations have more ways than ever to reach, engage and convert customers with an ever-evolving technological landscape to facilitate these activities.

But despite this, many organisations are struggling to manage increased competition, deliver growth and demonstrate sufficient return on investment of their expenditure in technology, software and programmes of digital transformation.

Despite the growth in the market, many organisations are finding it harder, not easier, to innovate and move forward, feeling like they are falling behind despite running as fast as they can to keep up.

This is an interesting paradox; why is it that organisations are struggling to innovate and deliver growth against a market backdrop that is growing and innovating so quickly?

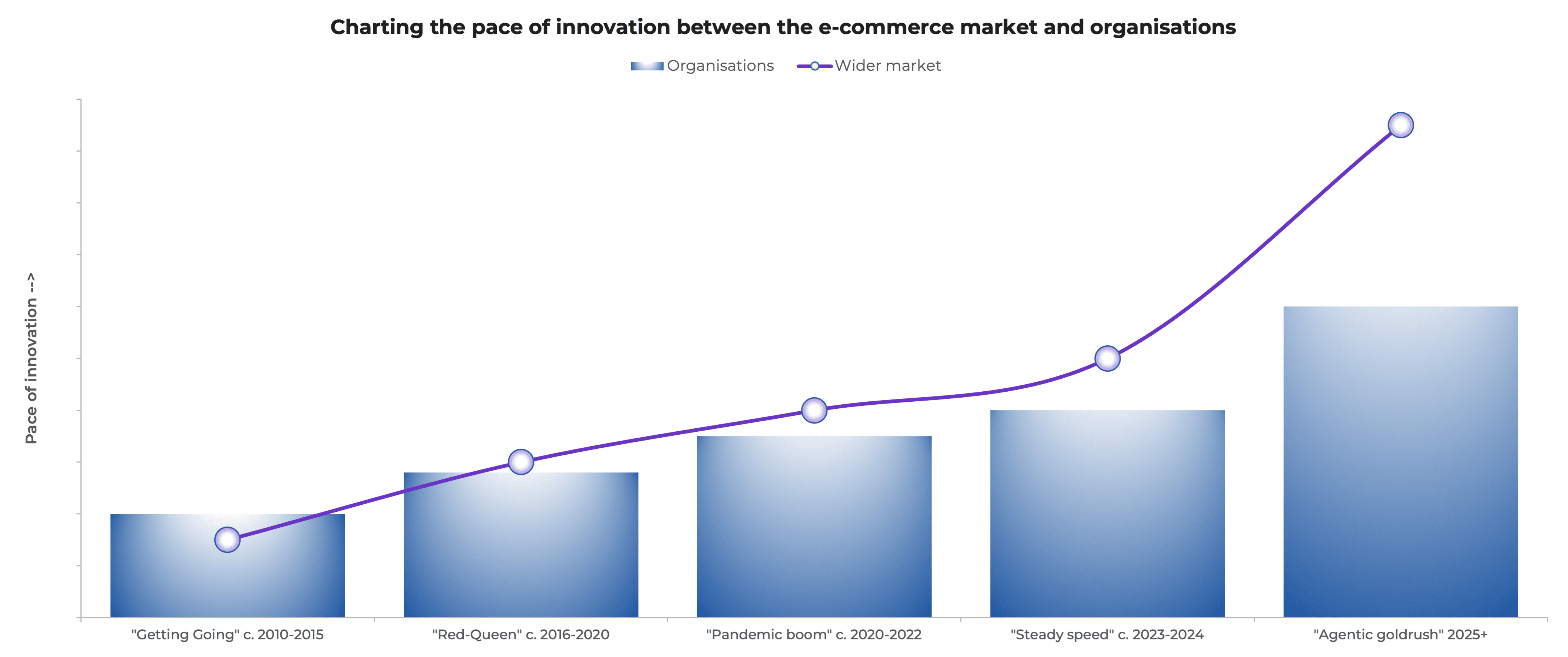

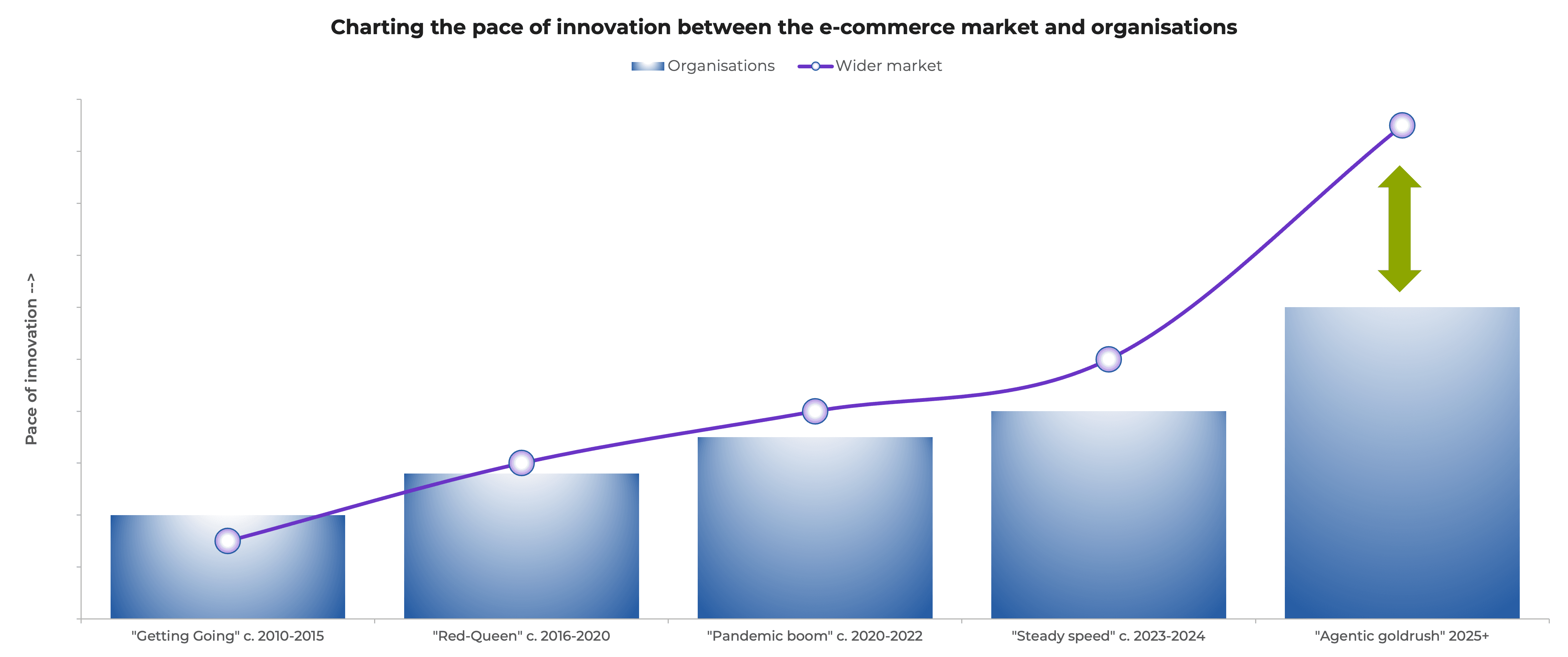

This difficulty moving forward has arisen due to an inconsistency in the pace of change in the market compared to that of organisations, a Digital Treadmill.

The Digital Treadmill

The digital treadmill describes a phenomenon we have been monitoring for the past ten years – an observation that organisations are having to ‘run’ faster to keep up with a market that is changing and innovating beyond the capability of organisations to keep pace.

This difference between the rate of innovation in the market and the ability of organisations to keep up – the innovation gap – has been growing since the mid-2010’s and is now at its widest point at any point in the last decade, as visualised below:

The Digital Treadmill: A comparison of how the pace of innovation in E-Commerce has outstripped the ability of organisations to keep up

Having followed digital commerce for over ten years we can identify five distinct phases of innovation with each phase being characterised by an increase in pace of change, both in the rate of change in the market and the ability of organisations to keep up:

Getting going

Broadly 2010 to 2015, a period characterised by a relatively slow pace of change in digital organisations but a slower rate of change in the wider market. Software solutions across analytics, optimisation, digital marketing, social media etc. we’re still in relative infancy and organisations could make forward progress with minimal investments in technology, professional services etc.

The Red-Queen

Broadly the mid-2010s to 2020, just before the pandemic. This phase is associated with organisations running as fast as they can but staying in place (like the red queen in Alice in Wonderland) against a market that was innovating and changing just as quickly. During this period organisations were required to invest more in keeping pace but, compared to what we have seen since COVID, these investments were modest and against a backdrop of relatively gradual change – it was possible to keep pace and, in some cases, move forward, although it may not have felt like it at the time.

The Pandemic Boom

The pandemic; 2020 to 2022. This phase is characterised by sudden changes and upheaval in customer behaviour, we saw a substantial shift in buying behaviour to online channels (up to 30% of total spending) which drove significant growth in online revenue, organisational attention and investment. This influx of attention and money allowed digital teams to move forward at a greater pace, delivering technical innovations more effectively that would have been impossible pre-pandemic. Whilst the wider market was beginning to show evidence of overtaking the ability of organisations to keep up, the gap was minor and possible to bridge through increased investment. Although returns on investment were beginning to decline this was broadly accepted as the cost of doing business at a time where the market was predictably unpredictable

Steady Speed

The couple of years of relative stability following the end of the pandemic, broadly 2023-2024. During this period, we saw a settling of the unpredictability seen during COVID, customer behaviours were becoming ‘locked in’ with e-commerce channels becoming a key focus for organisations. Growing on what began during the COVID boom the market was beginning to outstrip the ability of organisations to keep up owing to a new technology called Chat GPT that was launched in late 2022, initially to mild curiosity from the market but this grew exponentially and quickly took over all conversations as we approach the current phase of innovation...

The Agentic Goldrush

The “steady speed” phase started to end almost as soon as it began with the launch of Chat GPT (in late 2022) and during the last couple of years (to Q4 2025) we have seen the most substantial technological advancement than at any point in the past 15 years (at least as far as digital retail goes); the advancement of AI technologies and their application to every aspect of life, both within and without of digital channels has resulted in an increase to the rate of change such that it is no longer for digital organisations and retailers to keep up…

The speed of innovation in e-commerce has been gradually accelerating over the past 15 years, with organisations having to work harder and spend more just to keep pace. But like any treadmill, there reaches a point where you simply cannot keep pace and begin to fall behind – this is experience of countless organisations in 2025, they are stuck on a treadmill that is about to throw them off the end.

Artificial Innovation, Organisational Stagnation

During the past 18 months we have seen the widespread adoption of AI technologies in digital commerce, this being the driving factor behind the rapid increase in the pace of innovation that the market is now experiencing.

No doubt the introduction of AI has enabled organisations to innovate faster through automation and gains to efficiency, but this must be viewed against a backdrop of breakneck technological advancement in the wider market.

To highlight this, the following innovations in digital commerce have all arisen in the past six months (to November 2025):

Open AI has announced plans to allow user to buy products within Chat GPT, potentially removing the need for a D2C channel entirely

Optimisation of content for AI is encroaching upon SEO for attention and is leading to the creation of an entirely new discipline (GEO – Generative Engine Optimisation), which of course will require the creation of new budgets from organisations to fund these services (more cost, more attention, more pressure)

AI generated creatives and digital marketing campaigns delivered solely by AI agents that offer substantial cost savings (allegedly)

Traffic referrals through AI platforms are increasing exponentially and eating into organic search as a key source of traffic

The introduction of a Chat GPT powered web browser

The use of AI to create product images, description and meta data

The above represent a select example of technological innovations associated with AI, the true scale of change is even larger – how are retailers supposed to keep up with this scale and pace of change?

Whilst being introduced to every aspect of digital commerce technology, AI itself is innovating and changing faster than organisations can respond; in less than two years, what was once called AI was quickly rebranded as ‘Generative AI’ and is now being called ‘Agentic AI’. Not content with only two re-brandings there are already murmurings of this being evolved into AGI (Artificial General Intelligence) – these advancements in AI have taken place before organisations could even embed first edition AI into their operating models successfully (approximately 95% of AI initiatives fail to deliver value, as demonstrated by research conducted by MIT)

This all serves to fuel the perception that if you’re not using AI, or at least not investing in new technologies that use AI, you’re going to be left behind, a mentality which only services to further accelerate the pace of the change in the wider market, whilst organisations and budget holders are left scrambling to keep up.

This is the nature of the innovation gap, that as technology moves further away the pressure on organisations, decision makers and budget holders will only increase. Demanding more investment, more time and more energy... But rarely delivering a return sufficient to justify this investment.

Why you can't keep up

The implications of the innovation gap for digital organisations are significant with decision makers being pressured to invest in what feels like a new technology or AI solution every week.

An important question to answer at this point is why organisations can’t keep up – if organisations have access to these technological innovations why is it that they are failing behind?

The challenge here is not what is possible but rather practical, organisations simply do not have enough budget or bandwidth to find, contract, onboard and implement a new technology solution every month. Budgets are tightening and the pressure to deliver impact is growing, investing in new technology is time consuming, expensive and without a demonstrable return on investment may do more harm than good.

Additionally, as explored in our last article, the lack of an effective process for data, insight and experimentation limits the ability of organisations to effectively respond to changes in the market, particularly technological innovations.

Organisations and decision makers are therefore battling two challenges, both of which hold back their ability to innovate and keep pace:

Limited budgets and bandwidth that reduce the amount of time organisations can invest in technology, particularly the onboarding of new technologies

Ineffective processes for data, insight and experimentation – organisations do not know where to focus their activity and so struggle to make informed decisions as to where to invest

It is not the fault of the organisation, or teams within organisations, it is simply no longer possible to maintain pace, the innovation gap cannot be closed by simply ‘working harder’ or even…. by AI.

The cost of trying

As explored, the pace of change being driven through AI is making it nigh impossible for organisations to keep up and historical strategies for closing the innovation gap i.e. investment, are no longer practical; the level of cost required to bridge the gap is simply too high:

Historically, organisations have bridged the innovation gap through investment, however the scale of the difference is now too large for organisations to close through more spending – the budget isn’t available

The scale of the innovation gap and the level of investment necessary to close is staggering. Total global investment in AI is expected to reach £1.12Tn in 2025 alone (4), to provide some context of this:

The entire GDP of the UK is $2.7Tn (5)

Total E-Commerce spending in the UK in 2025 is expected to be £0.29Tn (2)

The total estimated value of the UK crown jewels is a mere £0.005Tn (6)

Obviously, of the total £1.12Tn of global investment in AI only a fragment is associated with digital commerce and of that an even smaller part is contributed by retailers. But on the other hand, at some point, technologies that have poured millions or even billions into AI will expect to see a return on their investment, and it will be digital organisations and the customer who will be expected to provide this return.

The result – organisations and decision makers are going to be increasingly pressured to invest in AI-powered technologies and solutions, but the level of investment required makes it unlikely, or even impossible, for these technologies to generate a positive return on investment. This in turn will drive the need for more investment in technology (because ‘software is the solution’, hint – no it isn’t, see our article exploring this falsehood) and organisations will find themselves having to make ever larger investments in technology and AI but without ever being able to demonstrate a commercial impact or close the innovation gap – there will always be a new technology and you will always be one step behind.

This can only lead to stagnant growth and, ironically, a loss in the pace of innovation – the market will continue to pull away if you try to buy your way forward.

What you can do about it

It is no longer possible to keep up through increased investment – you literally cannot work any harder or spend enough money to bridge the innovation gap.

You cannot work harder, you have to work smarter

What does this mean for organisations and budget holders?

You need to focus your investment, of time, resources and money, on technologies and solutions that are most likely to drive a commercial impact and positive ROI – you must be more selective in where you focus your attention

You need to validate the commercial impact and ROI of your investments, all of them, and you must ruthlessly assess your investments for impact and roll back investments in technology that do not drive value

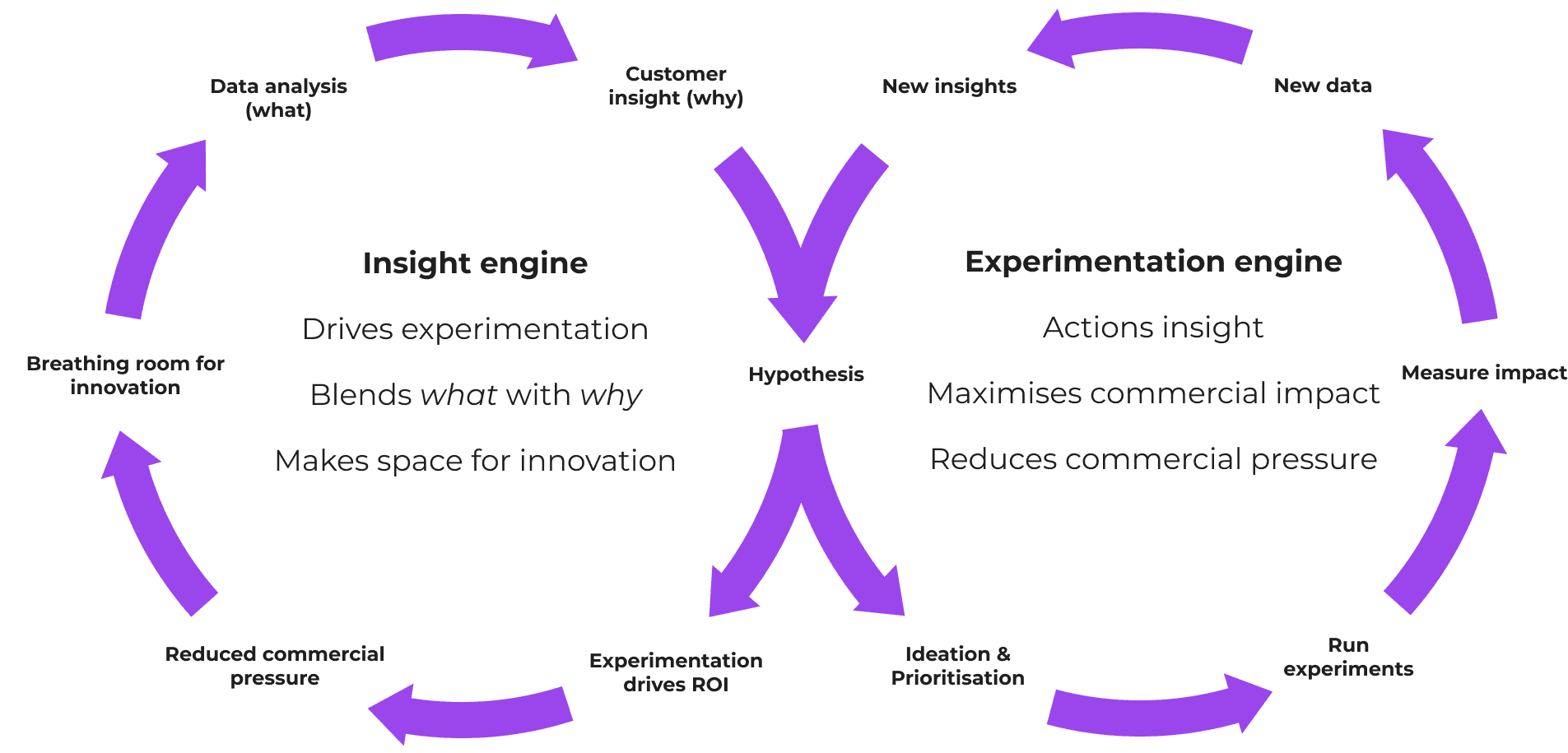

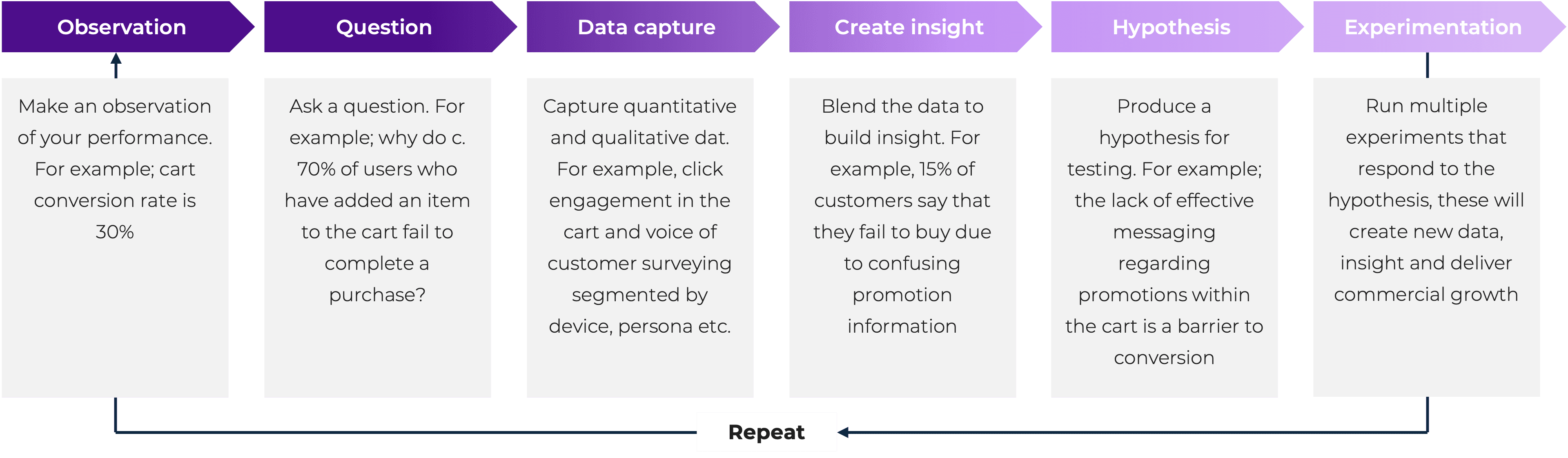

What this means in practice is that organisations need a more data centric, scientific approach to innovation, one that ensures decision making is aligned to tangible customer insights and validates the impact of these investments through experimentation. The Outsee Analytics growth engine provides a robust starting point for this approach:

As explored in previous articles, the growth engine is grounded in the scientific method – this being the most effective process for delivering innovation of online channels and validating their impact.

Organisations that effectively embed a scientific model for prioritising and validating their investments, not only in technology but also data, marketing etc. will benefit not only from a greater commercial impact of their investment but also a reduction in the commercial pressures and ‘noise’ that holds back strategic innovation roadmaps.

A practical example

Let’s imagine a scenario in which a retailer spends £100K per month on digital marketing campaigns, generating an overall ROAS of 450% - a solid return on investment. In this scenario the organisation is being encouraged to invest in an AI digital marketing solution that can automate the entire process across all advertising channels, ‘promising’ an increase in ROAS to 500% or more.

Sounds too good to be true and therefore an obvious investment, but anecdotal evidence online suggests that marketeers are not seeing additional revenue from their investments in AI. It is entirely possible that the organisation may invest in this technology but not see any appreciable ROI, particularly given the challenges with measuring ROI for low-intent paid marketing activity.

How might the organisation approach this AI solution using the scientific method:

Observation – Overall digital marketing ROAS is 450% but with significant variation between google shopping, paid search and social media with ROAS being 500%, 750% and 180% respectively

Ask a question – Why is social media ROAS so much lower than that other digital marketing channels

Capture data – Capture data regarding user engagement, click through rates and conversion associated with social media campaign traffic, segment this by the objective of the campaign and the target audience. Also investigate user engagement with social campaign landing pages and behaviour on the website – how does user engagement vary between social campaign traffic and other channels, where do users engage, what do they ignore and where do they abandon?

Create insight – The data may suggest, as it often does in the case of social media, that social media ROAS is low because paid social traffic is of lower intent that other marketing channels, the objective therefore of investment in social campaigns is not to drive conversion but rather to build awareness with the purpose of creating an audience for retargeting e.g. through email or remarketing campaigns

Prepare a hypothesis – For example, the intent of paid social traffic is significantly lower than that of other channels and therefore the opportunity for encouraging conversion from social traffic is limited, the role of paid social is to drive awareness and initial interest with the website serving to encourage account creation, use of wishlist and adds to cart with which we can create retargeting audiences to drive conversion in subsequent visits

Experimentation – A potential experiment that could be run in response to the hypothesis is to trial an AI solution for social media marketing with the objective being to maximise click through rate, additions of product to wishlist/cart and email marketing sign-ups. Furthermore, this experiment would also include the introduction of new landing page experiences (potentially as connected AB tests of existing landing pages) and new email marketing and/or remarketing campaigns target to these users, the result being a test of an entire customer experience requiring the involvement of multiple teams and their respective software suites (in actuality this is not as complicated as it sounds).

The above provides an example of how an organisation might focus technology investment on a particular opportunity or customer insight. Not only does this provide a significant cost saving in the short term (in this example the organisation would not invest in the technology outside of social media marketing) but it also provides a controlled environment to test and properly validate the commercial impact of the investment.

If we assume that this experiment is successful, a return on investment could be easily measured with ongoing investment in the technology being justified. Inversely, if no appreciable return on investment were observed the organisation could scale back their investment and move on – presenting a significant saving in both time and money. Regardless of the impact, the organisation wins.

Conclusion

Ongoing advances in artificial intelligence since the launch of Chat GPT in late 2022 have driven an acceleration in the pace of innovation beyond the ability of organisations to keep up, with decision makers and budget holders being pressured to invest more time, energy and budget into technology as the only route to growth.

However, the market continues to move forward and at an ever-faster pace and so the need for investment never diminishes – there is always a new technology, a new AI or a new trend to catch up to. Organisations are finding themselves running as fast as they can but falling behind – the innovation gap.

Given that increased investment will never be enough to close the innovation gap a smarter approach is required. One that provides decision makers the clarity of understanding required to both inform their investments and validate the return of these investments at speed.

By embedding the scientific method, robust data and a customer centric approach to decision making throughout digital effectiveness, decision makers can be empowered with the necessary depth of understanding to prioritise their investments against the greatest commercial opportunities and to validate the impact of these investments through an impartial, statistical analysis of the impact.

If followed, decision makers will find themselves being more focused on the real opportunities for growth that can be captured quickly through strategic investments in appropriate technology that delivers innovation and commercial impact.

References

www.ons.gov.uk/businessindustryandtrade/retailindustry/timeseries/j4mc/drsi

www.yourecommerceaccountant.co.uk/number-of-new-ecommerce-businesses-2025/

www.searchhog.co.uk/ecommerce-facts-stats-uk/

www.gartner.com/en/newsroom/press-releases/2025-09-17-gartner-says-worldwide-ai-spending-will-total-1-point-5-trillion-in-2025

www.tradingeconomics.com/united-kingdom/gdp

www.thenaturalsapphirecompany.com/education/fun-sapphire-facts/the-british-crown-jewels/